Encourage Your Business: Bagley Risk Management Insights

Encourage Your Business: Bagley Risk Management Insights

Blog Article

Understanding Animals Threat Defense (LRP) Insurance Coverage: A Comprehensive Guide

Navigating the realm of livestock threat protection (LRP) insurance policy can be an intricate undertaking for lots of in the agricultural market. This sort of insurance coverage offers a safeguard against market changes and unforeseen circumstances that could influence livestock producers. By comprehending the intricacies of LRP insurance policy, producers can make informed decisions that might guard their operations from monetary threats. From exactly how LRP insurance policy works to the numerous insurance coverage alternatives available, there is much to discover in this extensive overview that might possibly form the way animals producers approach threat administration in their services.

How LRP Insurance Works

Periodically, understanding the mechanics of Animals Danger Protection (LRP) insurance can be complex, however damaging down just how it works can provide quality for farmers and herdsmans. LRP insurance policy is a danger management device created to safeguard livestock manufacturers versus unexpected rate declines. The policy enables producers to set an insurance coverage degree based on their particular demands, selecting the variety of head, weight range, and coverage rate. When the plan is in area, if market rates fall listed below the coverage cost, producers can sue for the distinction. It is necessary to keep in mind that LRP insurance coverage is not a revenue warranty; instead, it concentrates only on price threat protection. The insurance coverage duration generally varies from 13 to 52 weeks, supplying flexibility for producers to pick a period that aligns with their production cycle. By using LRP insurance, herdsmans and farmers can minimize the monetary dangers connected with changing market value, ensuring greater security in their procedures.

Eligibility and Coverage Options

When it comes to protection options, LRP insurance policy provides producers the flexibility to pick the coverage degree, insurance coverage duration, and endorsements that ideal suit their risk management requirements. By understanding the qualification requirements and protection choices readily available, livestock producers can make enlightened decisions to handle threat effectively.

Pros and Disadvantages of LRP Insurance

When evaluating Animals Danger Security (LRP) insurance, it is important for livestock manufacturers to weigh the drawbacks and benefits integral in this threat management device.

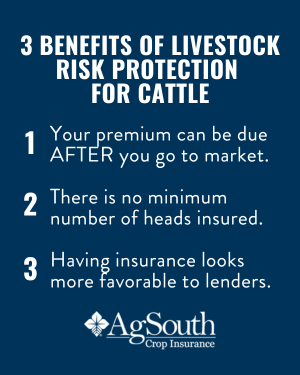

One of the primary advantages of LRP insurance is its capacity to offer defense against a decrease in livestock rates. In addition, LRP insurance policy supplies a level of adaptability, allowing producers to personalize protection levels and plan periods to suit their details her latest blog requirements.

Nevertheless, there are additionally some downsides to consider. One constraint of LRP insurance policy is that it does not safeguard versus all sorts of threats, such as illness break outs or all-natural catastrophes. Premiums can in some cases be pricey, specifically for producers with big livestock herds. It is important for producers to thoroughly examine their individual risk exposure and economic situation to establish if LRP insurance is the ideal risk management tool for their operation.

Understanding LRP Insurance Policy Premiums

Tips for Optimizing LRP Conveniences

Optimizing the advantages of Livestock Threat Security (LRP) insurance policy requires calculated preparation and positive risk monitoring - Bagley Risk Management. To take advantage of your LRP insurance coverage, think about the complying with suggestions:

Regularly Analyze Market Problems: Stay notified concerning market patterns and cost variations in the livestock market. By checking these aspects, you can make enlightened decisions regarding when to buy LRP protection to shield versus prospective losses.

Set Realistic Insurance Coverage Levels: When choosing insurance coverage levels, consider your production expenses, market value of livestock, and possible risks - Bagley Risk Management. Establishing reasonable insurance coverage degrees ensures that you are sufficiently protected without paying too much for unnecessary insurance policy

Expand Your Coverage: Rather than relying solely on LRP insurance, think about expanding your danger administration techniques. Combining LRP with other threat management devices such as futures contracts or options can give detailed protection against market unpredictabilities.

Evaluation and Readjust Protection Consistently: As market conditions alter, regularly review your LRP coverage to guarantee it aligns with your present threat exposure. Readjusting coverage degrees and timing of purchases can assist maximize your danger defense technique. By complying with these pointers, you can make best use of the benefits of LRP insurance and safeguard weblink your livestock procedure versus unexpected risks.

Conclusion

Finally, animals risk security (LRP) insurance policy is a valuable device for farmers to take care of the monetary risks related to their animals operations. By understanding how LRP works, qualification and coverage options, in addition to the advantages and my explanation disadvantages of this insurance coverage, farmers can make educated decisions to safeguard their resources. By very carefully thinking about LRP premiums and executing techniques to optimize advantages, farmers can alleviate possible losses and ensure the sustainability of their operations.

Livestock manufacturers interested in acquiring Livestock Risk Protection (LRP) insurance coverage can explore an array of eligibility requirements and protection alternatives tailored to their certain livestock operations.When it comes to insurance coverage choices, LRP insurance provides producers the adaptability to select the coverage degree, coverage duration, and endorsements that best suit their risk management requirements.To comprehend the details of Livestock Danger Protection (LRP) insurance policy fully, understanding the variables influencing LRP insurance coverage costs is critical. LRP insurance policy costs are identified by different elements, consisting of the insurance coverage level picked, the expected price of livestock at the end of the protection duration, the kind of animals being guaranteed, and the length of the coverage duration.Evaluation and Adjust Insurance Coverage Frequently: As market problems change, occasionally evaluate your LRP protection to guarantee it straightens with your present risk exposure.

Report this page